Flex EA Review

Flex EA is a popular expert advisor (EA) for the MetaTrader 4 and 5 platform. It is a fully automated forex trading system that uses a unique set of algorithms to analyze the market and make trading decisions. The EA is designed to be flexible and adaptable to changing market conditions, hence its name “Flex EA”.

Flex EA is a popular choice among forex traders due to its flexibility and adaptability. One of the key advantages of Flex EA is its ability to use multiple trading strategies simultaneously. This allows the EA to capitalize on different market conditions and maximize profitability.

Flex EA also offers a range of customizable settings and parameters, allowing users to tailor the EA to their individual trading preferences and needs. This includes options for setting stop loss and take profit levels, as well as the ability to adjust the EA’s risk settings and money management techniques.

In terms of support and resources, Flex EA provides a dedicated forum where users can share experiences and discuss strategies, as well as a user manual and video tutorials to help users get started and make the most of the EA. Additionally, Flex EA receives regular updates to ensure it is always running the latest version and is able to adapt to changing market conditions.

Overall, Flex EA is a powerful and versatile forex trading solution that offers a range of benefits for both novice and experienced traders.

Forex Flex EA is an extremely flexible(hence the name) forex robot capable of many powerful things. It comes pre-loaded with 12 unique strategies that you can switch to within the EA by just a click of the mouse. It’s basically like having 12 EAs in one! Their main strategy called ‘Default’ is a very interesting hybrid of grid and trend reversal. Some of you might hear the word grid and have concerns, but Flex does things quite different. It won’t start a grid until its core asset(its virtual trade technology) determines that it’s safe to do so. Most other grid systems out there open trades with no specific market conditions required, or use very basic outdated indicators which has always proven to fail.

Most of the accounts you see on this page are using the Default strategy on various currency pairs with all kinds of success.

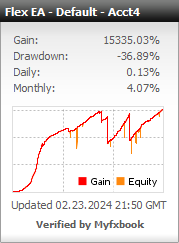

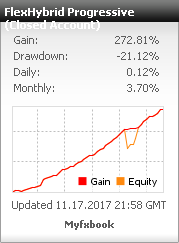

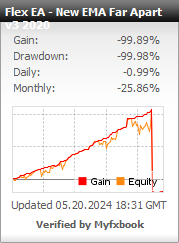

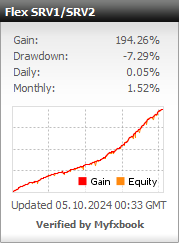

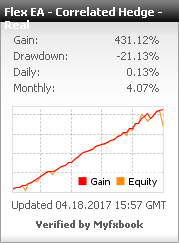

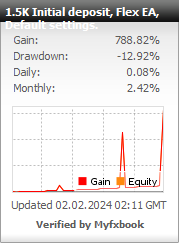

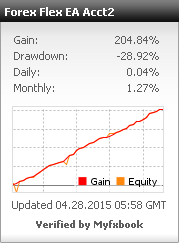

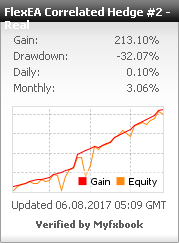

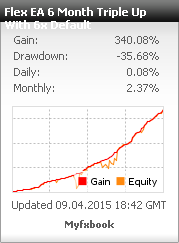

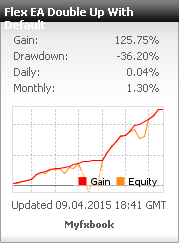

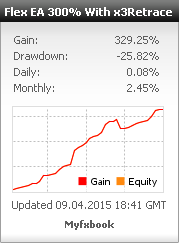

Flex EA Results

As you can see, there is no shortage of real money results with a decent amount of history behind them. This thing has clearly performed well for quite a while now. You will see the monthly gains range from 10% up to over 100% per month. While Flex can be setup to pump out 100% returns per month, it doesn’t come without high risk at these levels. Those kind of gains should not be expected to sustain month over month. If you’re looking for those kinds of gains, you better have an exit strategy to withdraw profits, and rinse and repeat. More sustainable long term gains are in the 10-20% range.

15 features of Flex EA

- Multiple trading strategies: Flex EA uses multiple trading strategies, including grid, martingale, and hedging, to adapt to changing market conditions and maximize profitability.

- Customizable settings: Flex EA offers a range of customizable settings and parameters, allowing users to tailor the EA to their individual trading preferences and needs.

- Advanced money management: Flex EA uses advanced money management techniques, such as dynamic lot sizing and automatic risk management, to optimize returns and minimize risk.

- Real-time updates: Flex EA receives regular updates to ensure it is always running the latest version and is able to adapt to changing market conditions.

- Support and resources: Flex EA provides a range of support and resources for users, including a dedicated forum, user manual, and video tutorials.

- Virtual trading: Flex EA offers a virtual trading feature, allowing users to test the EA on a demo account before using it on a live account.

- Detailed trading results: Flex EA provides detailed trading results on its website, showing the EA’s performance and profitability over a specified period of time.

- Multiple account support: Flex EA can be used on multiple accounts, with different pricing options available to suit different needs.

- Multiple currency pair support: Flex EA can be used on a range of currency pairs, including major, minor, and exotic pairs.

- Multiple time frame support: Flex EA can be used on different time frames, allowing users to customize the EA to their individual trading preferences and needs.

- Multiple broker support: Flex EA is compatible with a range of brokers, including popular platforms such as MT4 and MT5.

- Automatic trade execution: Flex EA executes trades automatically, allowing users to set and forget their trading strategy.

- Multiple language support: Flex EA is available in multiple languages, including English, Spanish, German, and French.

- Comprehensive user manual: Flex EA provides a comprehensive user manual, covering all aspects of the EA and its features and capabilities.

- 24/7 customer support: Flex EA offers 24/7 customer support, providing users with assistance and support whenever they need it.

What are some good Flex EA settings?

The best settings for Flex EA will depend on the individual trader’s goals, objectives, and preferences. However, some commonly used settings for Flex EA include:

Low risk settings: For traders who prioritize capital preservation and risk management, low risk settings can be used. This involves setting a low stop loss level and using a conservative money management strategy.

High profit potential settings: For traders who are looking to maximize profit potential, high profit potential settings can be used. This involves setting a higher take profit level and using a more aggressive money management strategy.

Multiple trading strategies: Flex EA offers the option to use multiple trading strategies simultaneously. This allows the EA to adapt to different market conditions and capitalize on different opportunities.

Customizable settings: Flex EA offers a range of customizable settings and parameters, allowing users to tailor the EA to their individual trading preferences and needs. This includes options for setting stop loss and take profit levels, as well as the ability to adjust the EA’s risk settings and money management techniques.

Overall, the best settings for Flex EA will depend on the individual trader’s goals and objectives. It is important to experiment with different settings and strategies to find the combination that works best for you.

How Flex Works

Simplicity

You can select the strategy you want to use from a drop down list when you attach the EA to a chart, set your Risk and that’s it. It will do the rest for you. Not only are there now over 12 built-in strategies to chose from, there is now a private member forum where 100s of privately optimized .set files/strategies can be downloaded for free. This is where the value of a community really comes through.

Ready to go, out of the box settings. Simple plug and play. Works best on (GBPUSD, USDJPY, USDCAD, USDCHF, EURUSD, AUDUSD) but can be traded on just about any currency pairs if you desire. You will see some of the accounts are trading 20+ pairs very successfully.

Precision

Flex EA uses a newly developed innovative technology involving “virtual trades“. Simply put, Flex will open virtual trades in the background, using them to constantly monitor the market to help determine the absolute perfect entry point, at which point Flex will start opening real trades.

New market monitoring, virtual trade technology brings precision entry points that no indicator can compete with. The default settings will use 6 virtual trades per currency pair to monitor market conditions. Lowering this number will result in less accurate entry points, but higher trading frequency. Raising this number will do the opposite.

Flexibility

Flex EA can be setup to trade just about any trading strategy imaginable. It comes 12 unique built-in trading strategies that you can select with a click of the mouse.

These are just a few of the built-in strategies:

Default – This is a hybrid trading strategy of Super Precise, Half Grid and Trend Surfer.

v2Default – New v2.0 strategy based off the original with some slight backend algorithm tweaks.

Super Precise – This opens trades very rarely, but when it does it’s very accurate.

Scalper settings – Scalps small profits during market corrections.

Full Grid – Your traditional martingale style trading.

Half Grid – Not as risky as Full Grid, about 50% less trading frequency.

Trend Surfer – Similar to Super Precise and Default settings but with bigger TP values.

Shotgun – Throw paint at the wall and see what sticks. This is a fun strategy but also very risky!

Pricing

Flex EA

- 1 Live Account License

- Unlimited Demo Accounts

- 12 of 12 Unique Strategies Included

- Full Access To Private Forums with 100s of custom set files

- 67% Off Coupon Code:

FLEX67OFF

*regular $1059

$349

Flex EA + Correlated Hedge EA

- 2 Live Account Licenses

- Unlimited Demo Accounts

- 12 of 12 Unique Strategies Included

- Full Access To Private Forums with 100s of custom set files

- Both Licenses Can Be Used With Either EA

- 67% Off Coupon Code:

FLEX67OFF

*regular $1515

$499.95

Conclusion

Flex EA is certainly something new and refreshing that this automated forex industry has desperately needed for years now. Another invaluable part of Flex is their very active member forums that contains a load of fantastic information and including lots of very good private .set files. The information provided in this review is only scratching the surface of what Flex has to offer. Don’t be afraid of too many settings or too much to learn, there are boat loads of .set files you can download and simply plug and play that optimize all the settings for you. There is even a 30 day money back guarantee if you’re not happy.

Here is another Forex Flex EA review by FNT.

Good day all,

Is anyone still using this EA? How is the current performance and what setting works well?

What brokers are people using with Flex? Also are you using a vps or not?

Anyone still using this EA? How has it held up with recent market volatility?

-raises hand-

It’s actually one of very fews eas that im trading with that actually survived, most everything was blown and suffered major losses.

Do any of think this is a good startup EA for beginners? I’m in the process now of trying to recover losses even from an EA I purchased a couple months ago.

Yup I have been doing quite well with the RSix3 Candlesize 75 strategy, but always looking for more. Cerul what strategies are you using?

Also using that strategy, with a modified version on another account with a smaller candle size filter of 60 so it trades a bit more.

I’m from the US and Ive been using this ea for about 2 years with all default settings and Default Strategy out of the box, no changes to anything, on a live account and I can honestly say this robot works. I will be trying the flexhybrid strategy and come back and give an update.

I recommend this EA to anybody, It’s one of the best in the market.

Hi can I trial this product before I buy it as I’m very new to trading and require the bit to be totally hands free?

Can I buy using bitcoin or neteller?

Hi Stanley, the minimal deposit depends on the leverage, 1:500 and $300 should be enough. First try on demo, you’ll save a lot of money.

Change to another account is easy and free, just change the account number in your profile.

hi Joe Stevens, i wish to know how much amount of minimal deposit is recommended to use forex flex ea? n if i buy this ea, i apply to 1 account, can i to change to another account? if i can, how much the charge for changing account?

Anyone else using the new eurusd stoch D scalper that was posted in the forum a few months ago? It’s been doing well for me but curious if anyone has made any adjustments or tried it on other pairs?

I haven’t tried other pairs, been running it on EURUSD M30 as recommended and it hasn’t lost a trade yet with a max drawdown of only 5% so far. I really like it’s entries, very smart stuff.

Please how do i access the new eurusd stoch D scalper? I bought this EA since 2015 and not even used it. I am trying to consider using it now.

Thank you

It’s in their member forum here: https://forexflexea.com/forum/Thread-RSix3-Scalper-v2-and-beyond

Can confirm the RSIx3 Scalper D Stoch v3 EURUSD M30.set has been performing extremely well for me, haven’t tried any of the others from that thread yet but I see others posting similar success in the thread as well.

The EA system is incredible at making consistent profits long term. Hands down best Ive ever seen. It learns and gets to know the movement of the market and executes trade after trade in glorious precision. Run on demo for at least 2 weeks to go Live. Well done.

What .set files is everyone using now a days? I had a lot of success with progressive flexhybrid early last year, but then took my profit and traveled. I am back looking to do the same, still a viable strat?

Yes Progressive Flexhybrid still doing wonders for me, there is also quite a few .set files in the member forums that have done particularly well for me like the Global Progressive RSI H1 and Global Double Edged TDI Slope H4

I have to say this EA has been a pleasant surprise. I have been through a lot of hot flaming garbage ea’s, its quite embarrassing actually 🙁 This is the only one that actually worked straight out of the box without fiddling with settings. Its also the only EA where the customer support is provided by the developer himself. Every other EA I had to try to explain my problems to outsourced Indian customer support that didn’t have a clue.

Thumbs up for this breathe of fresh air.

what settings you use?

Been using the progressive flexhybrid set file on the same pairs shown in their myfxbook account.

Hello,

How is the percentage of profits going? With this configuration

Yours sincerely

very great software

How long are the trades usually open? Do they close within the day, or are they open for days/weeks?

Does anyone have a MQL5 signal using Flex EA? I want to see some live performance?

I can only find myfxbook signals.

How do I purchase this robot

Somebody is using the new “hedging” function successfully?

If yes, what strategy and what settings?

Hi FFX,

currently I can’t recommend the new hedging feature. Against my principles I used it on real account on loosing trades. With V4.12 it opened a bench of hedge trades with pyramiding lot sizes. I had at sudden ~15 lot opened. With V4.13 there it opens only 1 hedge position with a TP. When TP is hit it opens another one. However, your initial basket in that time is still collecting DD. In addition if the market turns and moves against your hedge, there you will add additional DD depending on lot multiplier for hedge. Hence it is very risky to use if you don’t closely monitor.

In V4.20 there are some improvements on the hedging feature such as definable SL and TP, but it’s still beta and I don’t re command to use it yet.

I believe what you’re talking about was fixed in 4.13 where it doesn’t open larger lot size hedges over and over.

Thanks GP.

I hope that Steve soon explain to us, what is the “recovery” setting and how to set it.

And not least, he explains the new strategy “related hedging”

Hi all,

Please have you the ADRDynamic setting? it’s the best omly 5% DD?

i let you the link https://www.myfxbook.com/members/flexea/flex-ea-adrdynamic/1849919

Thank you

Can anyone help?

When I add the Ea to a chart and click ok, it says:

“News Indicator Not Found! News filter is being disabled”

Where is the News indicator to filter out big news from F Flex?

It is the FFCal.ex4 that comes in the zip file. It needs to go in your indicators folder.

Hello to all,

someone have the set parametre for the ADRDYNAMIC strategy?

thank you so much

please sir what is the best timeframe for flex ea and is 3xretrace good or no thank you sir

I always use H1, and I don’t use much of x3Retrace.

Running this EA for several weeks now and all goes well except that I have to figure out some way to prevent stop loss by major events like the GBP flash crash from last week. Also occasionally stop loss is hit due to trending. I use demo accounts of 1000 or 2000 USD with 0.01 lotsize.

One other problem is in the updates of flex. I got warnings from MT4 when v3.60 was released but it didn’t install automatically. So I had to manually reinstall all charts (many of them 🙂 )

I am also wondering what will happen to open trades when I install v4. Will the open trades be taken over by Flex 4.0, even when the timeframe and other settings are different?

Here are my 5 (to 500) cents on your questions. Please anyone correct me if I’m wrong.

For 100% there is no guarantee that you won’t loose in forex trading even with flexEA. In general there are 2 situations when those extreme movements can happen.

In addition it can be in a way planed such as

a) Economic news calendar events

b) unplaned – by market

Furthermore you may need to divide between

1) no trades open

2) trade basket open

Here are the “protections” flexEA and maybe others offer

1.a) Movement caused by news:

New news filter in V4. But keep in mind that sometimes even on medium impact news huge movements may occur or speeches may take some more minutes and then take effect on market.

1.b) No news driven: maxATR and maxSpread settings. Don’t leave maxSpread on on default 7.0! Don’t bother if those filters sometimes reduce trading frequency as they will save your account from big suffer.

In V4 there are next to the news filter much more filters to protect as much as possible.

SR filter and TDI are the ones I am currently interested in.

2.a) News related: New news filter can be configured in order to close baskets on MinsBeforeNews value of minutes. But that would affect every time a news event occurs.

Maybe the news filter on open baskets may be improved by something like

– stop open new trades (means pause basket during news)

– close if DD max % or $ (means if in profit or DD e.g. 1x% then close before news otherwise pray or use regular DD).

2.b) In case of a big move against your basket of trades, there is one major protection for your account that is the DD% value. Flex offers you to specify it on a per chart or a “global” basis called “allCharts”. But this only means all charts where flex is working on with the same magic number – keep that in mind if you user other EA as well.

In addition you may set a RealStoppLoss if the strategy you’re trading doesn’t set it by default.

In V4 there is also a new option (at least I didn’t see it before) called PauseBasketsAtDD. If you use it, flex stops adding more trades to the basket in the loosing direction.

In total I would wish some more flexible exit conditions in flex. The new entry filters look very promising, but exit is limited to a pip gain or trailing from a certain profit point or DD/SL. As this product is actively developed, I hope we see something like this in the future.

About the update thing I never saw a notification that there’s a new version. I check from time to time the web side .. currently on a daily basis.

The trick to not having to setup the charts on each update is to rename the ex4 file. I cut the version off and simply overwrite it on each update.

Finally as long as your magic number will not change, flex will trade your open trades. Just be careful that the new parameters are set correctly. If you want to save you custom settings, save the settings in a set file and merge it afterwards. Eg. I made me a .set file which contains only User and Strategy parameter. If you load this, only those values will be changed.

GP, which TDI settings do you use?

great tips for newbies GP!

been using Flex myself since august 2015 and am very pleased with it! Steve is very active in adding and coding new features and always replies very quickly when there a questions.

also I would like to see some feature in a future update:

a $/€ amount based ‘locked in profit’ setting. atm this is available with the equity trail on a % basis but I find it hard and cumbersome to find a proper setting as one has permanently adjust the values when the balance changes.

what I suggest is the following:

e.g.:

EquityTrailTP: 5$

LockedinEquityTrailSL: 1$

for the above setting as soon as a trade would be 5$ in profit a SL would be automatically set at +1$. if the trade continues in favour you just let it run until it hits your TP either pip based or your FloatingTP. if it retraces though all orders would be closed at +1$ and still secure a small profit. you would basically have a ‘risk free trade’ as soon as you’re in a profit zone.

of course the values have to be adjustable.

also I’d like to see a manual trade sequence setting:

e.g. 0.01;0.01;0.01;0.01;0.02;0.03;0.03.. etc

right now the above sequence is not possible as this is only adjustable with the lot multiplier which can cause too much of a drawdown when you’re trading micro lots as you need to have a lot multiplier of at leat 1.5 in order to get leverage.

finally I eould like to see a members’ only forum where we could discuss pairs, strategies and settings, etc.

take care anyobody and happy trading

“finally I eould like to see a members’ only forum where we could discuss pairs, strategies and settings, etc.”

This is a great idea,I agree !!!

I see they have a binary tab on this website but no good recommended systems for binary options. Is anyone using Forex Flex EA on mt4 platform to trade using binary options? If so, what recommended strategy is working and what timeframe within a expiry timeframe? Any indicators that you are using? Any suggestions?

I don’t recommend any binary option system because I believe it’s pure gambling.

Are people still having success with this? Been on the fence for a while, curious to know how people are liking it, and if any updates have been released lately?

Shhhh…. 😉

Haha I will take that as a good sign 😛

This is the best EA I have used that consistently makes money every week. Started in June 2016 with 5K and since made 2.3K profit. Probably would have had more profit but I took Steve’s recommendation to shut it down during the BREXIT vote. Started with low risk at first and have been increasing it steadily. I have used halfgrid, flexhybrid and default and all were profitable. Out of these DEFAULT is my favorite. I am currently experimenting with some of my own custom settings at the moment on my demo account.. I use 20 pairs with max charts 4 with the other settings set to default strategy settings. I have the EA loaded on a VPS and runs 24 hours 6 days a week. I sleep very well at night.

What is the best number of bars in the SR indicator setting to be used on a Nano acct. or Micro acct.? Is it best to use it with any other indicator or is that too much restriction on a given pair? Is it best to use the SR indicator by itself?

S&R filter is timeframe dependent, with that in mind I run it on H1 or H4 and use 24-48 number of bars to look back to determine the S&R levels.

Hi everyone can you please help, what would be the best broker for this EA? I will really appreciate your help. Diego

Hotforex and FXopen are the recommended brokers, but generally any MT4 broker will work.

Joe Steve , i am trying to reach to you , could you please send me your email to contact you asap . thx

hello,

i am interested in your EA.what is the percent result. weekly.and how to i make payment regards

Best EA I’ve ever used. One that actually works. Got each strat running seperately on 20+ pairs. Will share the results shortly

Hi, James, which settings do you use?

Hi Tebza. All strats on default settings at the moment. Flex takes some time to get going so waiting for a month or two before gradually increasing the risk level. WIll share results end of Sept

hey James can you please share your settings.

Thanks

I Think if we all work together we can Make this Awesome EA even Greater….

Sean I agree with you. So I share what I do in order to find the right strategy. I don’t focus on one single one, but for the best of each pair.

I user the strategy tester in optimization mode and let all settings as default and then switch on testing for the strategy from Default to ADR Dynamic.

I do this for each pair and a timeframe such as 1 year. As spread I use this table as I found it reasonable for my brokers for STP accounts (no commission).

EURUSD 1,5

USDJPY 1,5

EURJPY 1,5

AUDUSD 1,7

EURGBP 1,8

USDCAD 1,9

USDCHF 2,0

AUDJPY 2,0

GBPUSD 2,1

EURCHF 2,1

NZDUSD 2,3

EURAUD 2,4

CADJPY 2,4

CHFJPY 2,4

AUDCAD 2,6

NZDJPY 3,0

——————

GBPJPY 2,9

GBPCHF 4,0

The last 2 I don’t use as they are on the list of pairs to avoid.

Once I found the strategy for each pair that is profitable and with a reasonable DD I can use it with default settings or can try optimization of parameters.

But be aware, if getting too greedy even flex cannot help. All strategies are in a way MartiGrids and hence to start with a risk of 0,1 or 0,2 is the key for long-time success.

I forgot: In order to determine the strategy from the tester results use this table:

Strategy=0 Default

Strategy=1 v2Default

Strategy=2 SuperPrecise

Strategy=3 Trendsurfer

Strategy=4 Scalper

Strategy=5 Halfgrid

Strategy=6 Fullgrid

Strategy=7 Shotgun

Strategy=8 YourOwn

Strategy=9 FlexHybrid

Strategy=10 x3Retrace

Strategy=11 x2RetraceSL

Strategy=12 BigDefault

Strategy=13 ADRDynamic

GP, I’ve just bought a copy of this EA and would love to know how to set this up too!

GP, do you have a video of how to set this up?

Sorry Tre, I currently don’t have a video. But if you are a bit familiar with back-testing in MT 4 it is pretty easy.

I alsp recommand using 99% tickdata as most broker’s history is only a few month. Search youtube for MT4 backtest 99%

Here are the steps ..

1. If not already done, add the symbol you want the backtest to run in the market view (STRG-U)

2. Open Strategy Tester view (STRG-R)

3. Drag the Forex-Flex-EA from the Navigator window to the Strategy Tester view

4. Choose your desired symbol

5. Choose Model “Every tick”

6. Set period (flex is designed for M15)

7. Set Spread for your symbol according to the table in post #15

8. Check Optimization check-box

9. Click Expert Properties button (new window opens with 3 tabs)

10. On Testing tab set desired Initial Deposit and Optimization parameter .. eg. Balance

11. Check Strategy variable and choose for start column “Default” and for Stop column “ARDDynamic”

12. Click OK button (window closes)

13. You may adjust the test period by choosing dates at the “Use date” section. Eg. from 2016.01.01 to 2016.10.15

14. Click in Strategy Tester the “Start” button

Now it’ll take some time to process all tests as MT4 doesn’t support parallel testing such as MT5. However, you will find 2 new tabs after pressing start in Strategy Tester – “Optimization Results” and “Optimization Graph”. On Results you’ll find the list, which will be sorted by Profit after the last test is done.

That’s it.

1.

Sorry that image link is dead. Take a look here (don’t know how to embedd an image correctly)

ATTENTION: Since V4 the recommended time frame is 1H or 4H!! M15 was recommended in previous versions. Refer to the readme file that comes with the latest updates.

You can actually still use any timeframe, higher ones are recommended because 4.00 has the UseSR (Support & Resistance) turned on by default which is timeframe sensitive. It looks back ‘x’ NumOfBars, so you can understand why running this on M15 with a low NumOfBars will result in the SR lines being too tight to the current price.

Yup, I just started testing “scalper” mode and am using the 1M timeframe. I boosted the number of bars to 300 and it seems happy with that.

Okay Thanks GP!

In V4.04 the default settings were switched back to not use SR filter. Little confusing, but I think I’ll keep that.

Should the number of bars be lower on a one minute timeframe like ten? Why 300 works better?

When I selected the “Flexhybrid” strategy, the EA didn’t automatically set the parameters values. They are totally different than the ones mentioned in the documentation. Any idea/clarification?. For example, based on the Flex EA documentation, the RealTakeProfit and Pipstep should be 50 and 20 but the EA automatically set them to 30 and 15.

Hi everybody,

First, I would like to thank all of you for your valuable comments and for sharing your experience with us. Second, I have purchased Flex EA yesterday and I am interested to know which pairs are best for trading giving that I will apply the Flex hybrid strategy to all charts with a DD of 15% and a risk factor of 0.3. Awaiting for your responses. I plan to share with you the results after a month from now. Thank you.

Bought the flex ea yesterday and trying it on demo.any suggestions on the strategy to start with?

Hello,

I bought the flex ea yesterday and using it on demo.

Is is possible to use different strategies on 1 chart (eur/usd) , or every single strategy on different chart (eur/usd)

Thanks.

Yes you can trade 1 currency pair with every strategy if you wanted, but each instance of it will need a unique magic number to different it’s trades, which means the currency and max charts filter won’t work, which means it could trigger many strategies to trade at the same time.

I suggest testing this in demo first 😛

Just bought the EA. Anyone has any suggestions on the strategy? Which one is the best strategy for 15-25% monthly return with medium risk? Appreciate any suggestions.

Hello, did you use the same strategy in the document section of the Flex EA download to get those shotgun high risk results? If not, what strategy did you use to get the 274.20 percent results with the shotgun results?

The shotgun account is a vendor account, not mine. I believe it’s just the Shotgun strategy trading 16 pairs, including some high risk ones like GBPCHF, GBPJPY, EURAUD etc…

So far so good 🙂 I bought Flex a week ago, it took me week to figure out proper settings and now we’re talking :)So far this week major gain, 60% of deposit (and it not even ended yet:) I’m still running my demo account and trying to find perfect setup, I’ll share my settings when I run it live. It looks like very good ea, I hope it earns me some money.

P. S. : I’m using flexihybrid and hybridtrend (custom settings)

Hi Ziolo, could you share your settings?

Thanks

Did you mean trend Hybrid turned to on ? and how are things going so far

hello sir ,

please share profitable setting to me on my email id

thanking you……..!

Do far so good guys 🙂 I bought Flex two weeks ago, it took me week to figure out the proper settings and now we talking :)So far major gain in this week (and it not even end yet:) 60% of deposit. I’m still running my demo, account, trying to find a perfect setup. I’ll share settings when get it running on my live account. Very good ea so far !

Can anyone help me with choosing a broker for this EA?

Also what time frame is most effective?

any possible modifications?

thanks

Can I trade only 2 currency pairs using default settings? Assuming that my account balance is $1000 only.

hey guys, im considering buying this EA, i was looking quite a time for good EA, mostly i found later its scam or not working at all. Since i read quite a lot of reviews on this one i would try it.

I got some questions if anyone can answer: What broker should i use (europe) any suggestions or references?

What timeframe is most effective with this EA? I just add EA to pair on time frame and choose strategy thats it? and suggestions on customizing settings?

thank you very much,

regards

Hi Luka,

Looks great what system are you using, are you using default settings

Simon

Quickest +10% I ever made…

HI, what ea are using and where can i buy it? thanks

This is Flex EA using the v2Default strategy, no other settings changed.

dear luka

i am really impressed by your results,i bought this awesome EA 2 days ago,just wanna know which broker are you using? . In the demo xm broker account i have associated other indicators is’t something not to be done and let FLEX act by itself alone??One last question starding day must be sunday right and ending day saturday acoording to my location ALGERIA.Your help would be much appreciated .karim

Wow I woke up today worried that JPY mess was going to have some major losses, but to my surprise Flex went long almost perfectly at the bottom of this crash after the JPY news. Turned a nice little profit with no DD, unreal entry.

Got the same usdjpy trade, great entry point.

Anyone tried that new TrendHybrid setting yet? Looks interesting…

Yea ive turned it on with my trendsurfer and using default settings for everything else. It seems to help get out of drawdowns quicker. It seems like it’s basically TrendSurfer + Default strategies all in one. It adds to orders in profit, and adds if the price goes against. Its too early to say but it looks like it could be a good money maker.

I see Flexhybrid but no Trendhybrid. Where is this new Trendhybrid setting?

It’s near the bottom with ReverseMode, TrendMode and all those settings in v3.35

Okay Thanks! This don’t work on the live accts. right? Only for the demo accts.? I’m still using the 3.26 update. Let me know.

I’m using 3.36 on live accounts now, seems ok.

Problem has been solved, is my operation mistake

hi everybody,I enter my ID , according to the determined no icon is displayed

Please help me how to solve this problem

2016.02.11 12:32:46.739 Expert Forex-Flex-EA-3.20 EURUSD,M15: removed

2016.02.11 12:32:26.535 Expert Forex-Flex-EA-3.20 EURUSD,M15: loaded successfully

Why will automatically deleted?Please help me.

I have the same problem. What is to do to solve the problem?

Happy New Year. Such a wild ride in currency and stock market. Anybody profited in this EA or got stop out?

hi does it matter if yoy have flex on 15 mins charts 30 mins charts and so on I’m new to forex pairs any information I would be grateful.

It doesn’t make much difference going from M15 to M30 but going from M1 to H4 would have a noticeable difference.

I traded right through all of December and New Years without any problems. I also run modified Default strategy using trendmode so not sure if that had any affect on my positive results.

Agreed. December is a great month for me too on big default settings. I am shutting down the business and re-opens 4th Jan next year. Market is always there and 2 weeks of no production is not a big issue. Merry Christmas and happy holidays

December has been a great month, but should we stop trading now for Holidays? If so when should we start back up?

FlexHybrid superb trading, gracias 🙂

I made mistake had same pair twice on my charts that’s why it open 2trades on same pair at same time.

how profitable have you been?

Hi Guys, is it really working?

Sir,

Can with trade two strategy on the same MT4 platform/ account.

and what are the two best combination?

Thank you.

Tan.

hi guys can anyone tell me beat pairs to put on flexhybrid and how many ? also does EA input the leverage if so can a person change it? thanks any information would be greatly welcome. LETS MAKE MONEY

getting ready to purchase the Flex trader. Can I program it to trade the Bollinger bands and stochastic indicators on the 30 min chart. Long or short, with stop loss and

take profit protection.

Hi everyone, any update on flex EA. How is the performance?

Its actually been quite here for some time now. I just bought the EA but yet to install on my live account.

Please lets have some updates from those already using it

Hi,

what is the minimum deposit/investment needed for this EA in order to profit?

and what is the safest strategy to minimize the losses?

please advise.

Hi there,

I am very new to forex trading and have been experimenting with a demo account. I’d be lying if I said I was doing well despite using indicators on MT4 hence I have been investigating EAs. Have read several reviews on different products and they all promise exorbitant ROI looking at their backtesting results. It is all rather overwhelming.

The reviews above from you all seem promising. I do have a question which is to do with day trading. I am at work all 5 days but do have access to my MT4 platform. Has anyone tried day manual trading using this EA. If I were to invest in this EA I can automate it perhaps to the extent of alerting when to enter & close a trade & NOT to fully automate it where it does everything itself. A little too risky for my level of comfort.

Any advice? Also is there anyone from Sydney AUS using this EA. I’d like to hear from you as well.

Thanks

October has been a very solid month for me trading just the Default out of the box settings. Everyone else getting similar results?

Yup, BigDefault has been brilliant for me so far since mid September.

Ya, default ootb settings here too doing well for me at fxopen.